Page 104 - SAMENA Trends - January-February 2025

P. 104

REGULATORY & POLICY UPDATES SAMENA TRENDS

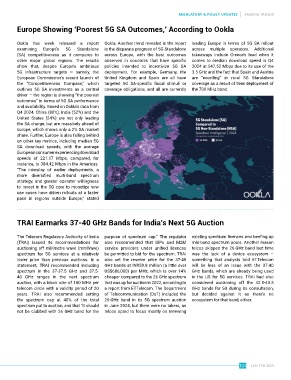

Europe Showing ‘Poorest 5G SA Outcomes,’ According to Ookla

Ookla this week released a report Ookla. Another trend revealed in the report leading Europe in terms of 5G SA rollout

examining Europe’s 5G Standalone is the disparate progress of 5G Standalone across multiple operators. Additional

(SA) competitiveness as it compares to across Europe, with the best outcomes takeaways include Greece’s lead when it

other major global regions. The results observed in countries that have specific comes to median download speed in Q4

show that, despite Europe’s ambitious policies intended to incentivize 5G SA 2024 at 547.52 Mbps due to its use of the

5G infrastructure targets — namely, the deployment. For example, Germany, the 3.5 GHz and the fact that Spain and Austria

European Commission’s recent launch of United Kingdom and Spain are all have are “excelling” in rural 5G Standalone

the “Competitiveness Compass,” which targeted 5G SA-specific fiscal stimuli or coverage as a result of their deployment of

outlines 5G SA investments as a central coverage obligations, and all are currently the 700 MHz band.

driver — the region is showing “the poorest

outcomes” in terms of 5G SA performance

and availability. Based on Ookla’s data from

Q4 2024, China (80%), India (52%) and the

United States (24%) are not only leading

the SA charge, but are massively ahead of

Europe, which shows only a 2% SA market

share. Further, Europe is also falling behind

on other key metrics, including median 5G

SA download speeds, with the average

European consumer experiencing download

speeds of 221.17 Mbps, compared, for

instance, to 384.42 Mbps in the Americas.

“The interplay of earlier deployments, a

more diversified multi-band spectrum

strategy, and greater operator willingness

to invest in the 5G core to monetize new

use cases have driven rollouts at a faster

pace in regions outside Europe,” stated

TRAI Earmarks 37-40 GHz Bands for India’s Next 5G Auction

The Telecom Regulatory Authority of India purpose of spectrum cap.” The regulator existing spectrum licences and beefing up

(TRAI) issued its recommendations for also recommended that ISPs and M2M mid-band spectrum pools. Another reason

auctioning off millimetre wave (mmWave) service providers under unified licences telcos skipped the 26-GHz band last time

spectrum for 5G services at a relatively be permitted to bid for the spectrum. TRAI was the lack of a device ecosystem –

lower price than previous auctions. In a also set the reserve price for the 37-40 something that analysts told ETTelecom

statement, TRAI recommended including GHz bands at INR59.8 million (a little over will be less of an issue with the 37-40

spectrum in the 37-37.5 GHz and 37.5- US$686,000) per MHz, which is over 14% GHz bands, which are already being used

40 GHz ranges in the next spectrum cheaper compared to the 26 GHz spectrum in the US for 5G services. TRAI had also

auction, with a block size of 100 MHz per that was up for auction in 2022, according to considered auctioning off the 42.5-43.5

telecom circle with a validity period of 20 a report from ETTelecom. The Department GHz bands for 5G during its consultation,

years. TRAI also recommended setting of Telecommunication (DoT) included the but decided against it as there’s no

the spectrum cap at 40% of the total 26-GHz band in its 5G spectrum auction ecosystem for that band, either.

spectrum put to auction, and that “it should in June 2024, but there were no takers, as

not be clubbed with 26 GHz band for the telcos opted to focus mostly on renewing

104 JAN-FEB 2025