Industry Thought Leadership

Winning with 5G: Considerations for Telecom Operators

January, 2019In many ways, 2018 was the year when the telecom industry globally and in the SAMENA region prepared for the next big technology leap with 5G. The industry body 3GPP finalized the first 5G New Radio standard with Release 15, technology suppliers launched 5G network products, regulators clarified their plans for the 5G spectrum, several SAMENA Telecom Operators piloted 5G networks, and the broader ecosystem players experimented with 5G use cases. These developments from all industry stakeholders have prepared the market for the first commercial 5G launches in the SAMENA region.

Although it will still be a few years before 5G becomes the mainstream communication technology, telecom Operators will need to play the lead role in 2019 to bring to market both consumer and enterprise 5G applications. They will need to decide their 5G strategy for not only how to deploy but most importantly how to optimize and monetize their investments.

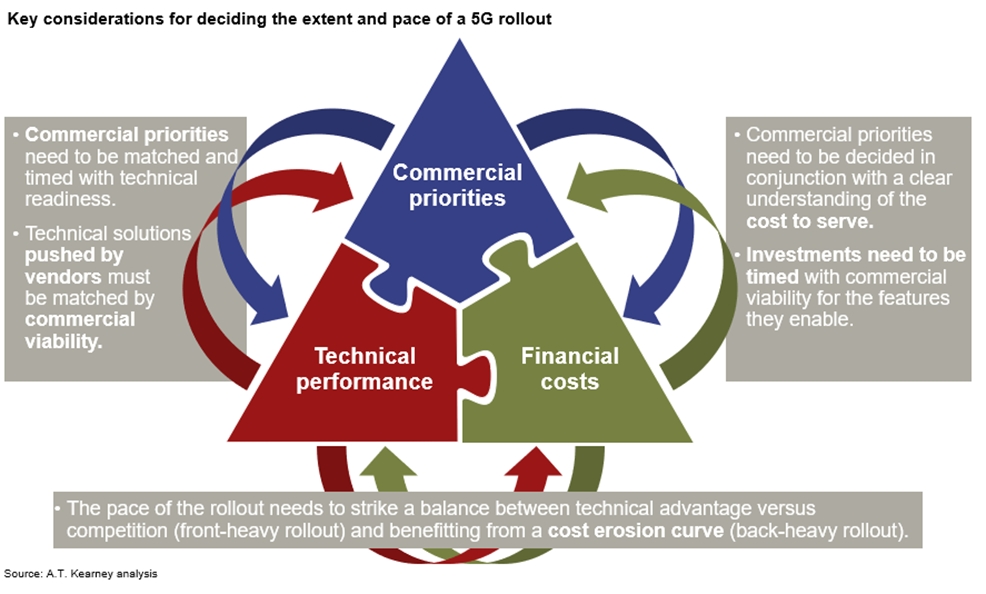

There are several important considerations for telecom Operators to maximize value from their 5G investments, along three main areas (see figure):

- Commercial priorities: What propositions can be launched to monetize 5G and with which ecosystem partners?

- Technical performance: Which technology choices will enable the most efficient 5G network rollout?

- Financial costs: How can telecom Operators negotiate the most favorable agreements with 5G technology suppliers?

Each operator needs to assess its market and its individual situation to make the best choices for a successful foray into 5G.

Commercial Priorities: Monetizing 5G

As the industry learned during the transition from 3G to 4G, the incremental monetization for telecom operators from faster speeds was short-lived at best. New use cases co-created with a broader ecosystem of partners from various industry sectors will be essential for operators to maximize the value of their 5G investments. Operators must understand and assess the use cases to choose the ones that are relevant for their individual markets based on the maturity of the ecosystem and consumers.

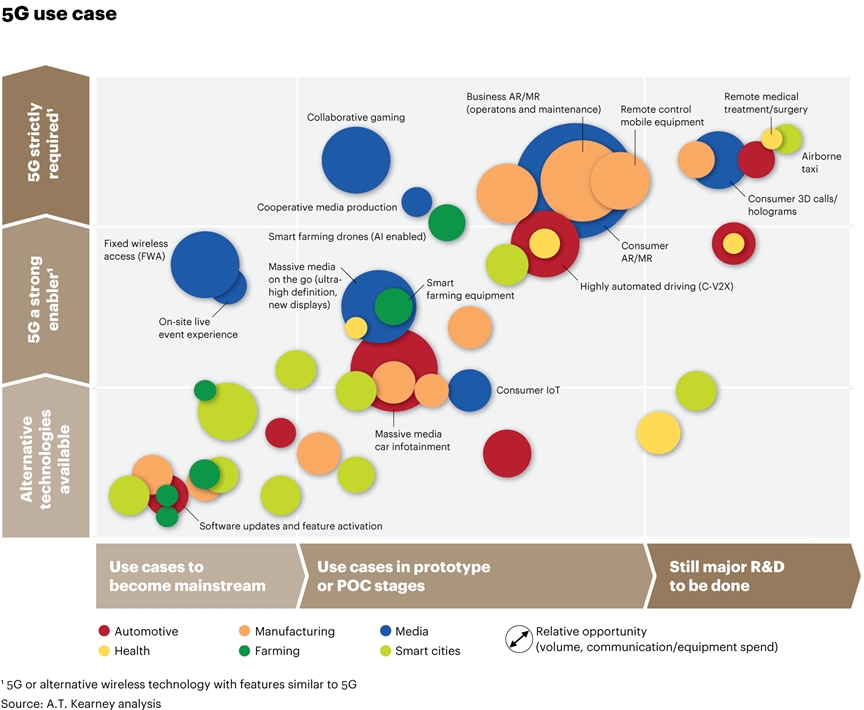

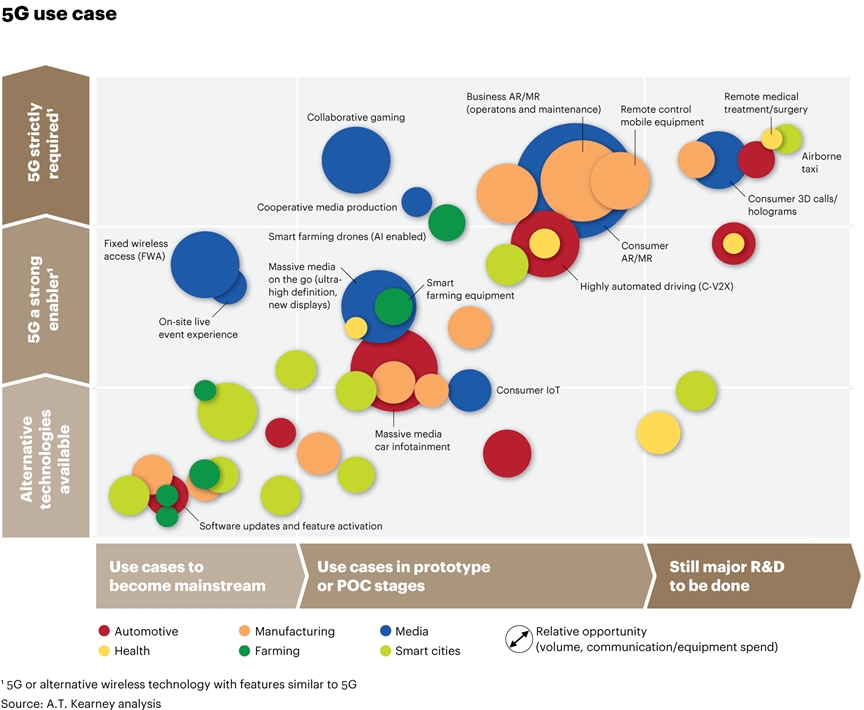

At A.T. Kearney, we have assessed more than 60 use cases covering mobility, manufacturing, media and entertainment, health, farming, and smart city applications, evaluating their ability to go mainstream and their 5G requirements (see figure). Globally, what we found is that the use cases with the highest requirements for 5G are mostly in business-to-consumer media, especially in augmented and mixed reality and in mobility, where highly automated vehicles will influence demand in the foreseeable future. In the SAMENA region, one of the key applications would be in enabling Industry 4.0 across various industries.

Hence, operators in the SAMENA region need to do major groundwork in 2019 to identify the use cases they want to deploy and in which sectors, determining the commercial proposition. They will need to find and join forces with ecosystem partners to go to market together and develop a pricing strategy to monetize their 5G investments.

Technological Performance: Deploying 5G

While 5G brings distinct advantages of ultra-high data throughput and ultra-low latency with high reliability, it also requires an ultra-dense network deployment and a new network architecture that is highly virtualized to allow slicing to suit individual use case. This will require telecom Operators to make massive investments in 5G deployment at a time when they also need to continue expanding their 3G and 4G networks, which will remain relevant for many years to come.

Based on our experience with 5G-related projects over the past few years, we know that operators will need to make many pragmatic technological choices. A value-based rollout of a 5G network using deep analytics-driven decision-making to prioritize deployment in areas with the highest monetization potential will be essential. Operators also need to fundamentally rethink their infrastructure-sharing strategies in a denser network realm and work with TowerCos plus new partners that own urban infrastructure assets such as Utility and Transport providers. And then there are broader radio technology strategy decisions to make, including turning off legacy networks such as 3G.

Financial Costs: Sourcing 5G

Telecom operators’ return on any 5G investment will primarily depend on their ability to source 5G effectively. Operators will need to develop a comprehensive approach to sourcing 5G, which begins with agreeing on the pace and extent of the rollout, managing technology interdependencies, and balancing short-term benefits versus the long-term cost of ownership (see figure).

Looking to secure a dominant market position, network technology vendors are eager to push 5G now, courting operators with lucrative deals including bottom-page discounts, free equipment, and engineering and rollout support. However, these incentives are typically one-off, do not include cost-erosion mechanisms, and are offered in exchange for long-term contracts. Operators need a robust method for comparing the full value in pursuing such long-term commitments early on, rather than assuming a higher cost up front to maintain competition down the road. Further, to best manage the growing interdependencies between different network and IT categories, Operators should develop and apply what A.T. Kearney calls a “mega-vendor” strategic sourcing approach, in which the scope of network and IT categories are bundled into one overarching negotiation process.

Conclusion

In 2019, as operators commit massive investments to 5G, they will need to make many wise commercial, technological, and financial decisions. These decisions cannot be made in siloes but require a cross-functional 5G task force with participation from all organization areas, including marketing, product development, technology, finance, and procurement as well as engagement with wider ecosystem partners and industry experts. Operators that define a comprehensive 5G strategy early on and guide its effective execution by engaging the best talent internally and externally will win in the race to 5G.