Industry Thought Leadership

Emerging 5G IoT Use Cases

December, 20195G, the fifth generation of wireless technologies, will be a critical enabler of digital transformation worldwide. Unlike previous technologies, 5G’s impact is expected to stretch far beyond just the telecoms industry and its users. It will transform societies and economies by providing continual and convenient access to mobile and fixed broadband services to its consumers and by nurturing the development of new use cases like augmented reality (AR), virtual reality (VR), autonomous vehicles and smart manufacturing for consumers and enterprises alike.

There are several characteristics of 5G networks that enable them to cover such a wide variety of use cases. For instance, high throughput (minimum 100Mbit/s as per ITU’s IMT-2020 standards) drives use cases such as VR for 4K/8K streaming. Low latency (1ms) is critical for use cases like autonomous vehicles and remote surgery. High connection density (1 million connections per km2) will help drive use cases such as smart meters. Finally, network slicing capabilities will help operators create private networks with high degrees of customization with very little integration effort (compared to dedicated physical networks).

1. Key use cases of 5G

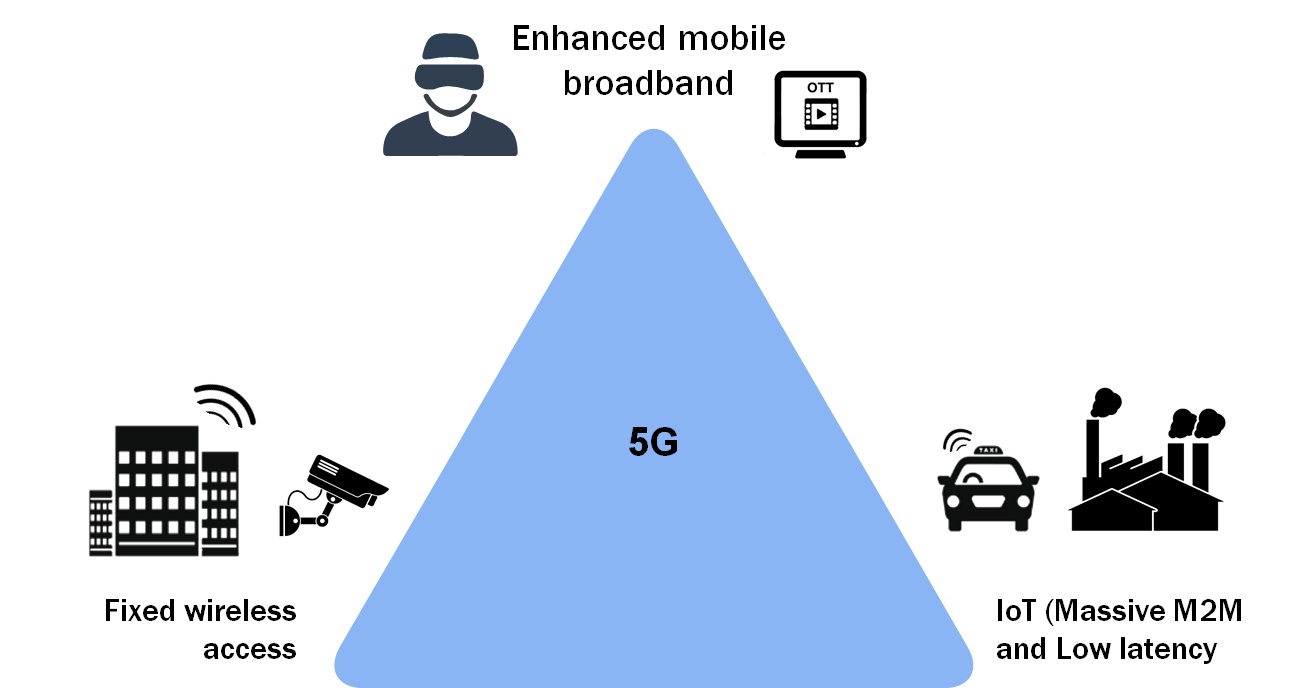

The wide variety of use cases that 5G supports can broadly be classified into the following three categories –

- eMBB (enhanced mobile broadband): extension to existing 4G broadband services which provides much higher throughputs and lower latencies

– in a recent engagement in a GCC country, Analysys Mason forecasted 5G share of all mobile connections to reach 25-30% by 2023 and account for 10-15% of the entire ICT market - FWA (fixed wireless access): provision of ultra-high-speed fixed broadband services, especially to suburban and rural dwellings with low access to fibre solutions

– 5G FWA is expected to account for more than 20% of all fixed broadband connections by 2023 in a leading GCC country - IoT (internet of things): an amalgamation of mMTC (massive machine type communication) and URLLC (ultra-reliable low-latency communication) use cases enabled by the high connection density, high throughput and low latency provided by 5G networks

– the number of IoT connections on 5G in MENA (Middle East and North Africa region) is expected to be ~3 million by 2028 with a higher revenue per connection compared to other technologies

Commercial deployments of eMBB and 5G FWA have started rolling out globally, with countries like Saudi Arabia and UAE leading the GCC region in terms of deployments. With both these use cases being extensions of similar use cases under previous cellular technologies (MBB and LTE FWA), the next section focuses on emerging 5G IoT use cases.

2. Emerging 5G IoT use cases

The technical capabilities specified for 5G (e.g. high throughput, low latency, positioning accuracy, devices per km2) allow for both an enhancement of current IoT use cases as well as enables creation of new ones. All industry segments are currently undergoing digitalization of their internal processes, operations and service delivery to improve productivity, enhance customer experience and address new market segments. 5G plays an important role in this transformation, not only to serve as a standardized technical connectivity protocol but also to collect and distribute operational and IoT generated data across the ecosystem.

The most ubiquitous and transformative 5G IoT use cases that have seen numerous trials globally include Augmented and Virtual Reality (AR/VR), smart driving, smart manufacturing and smart health.

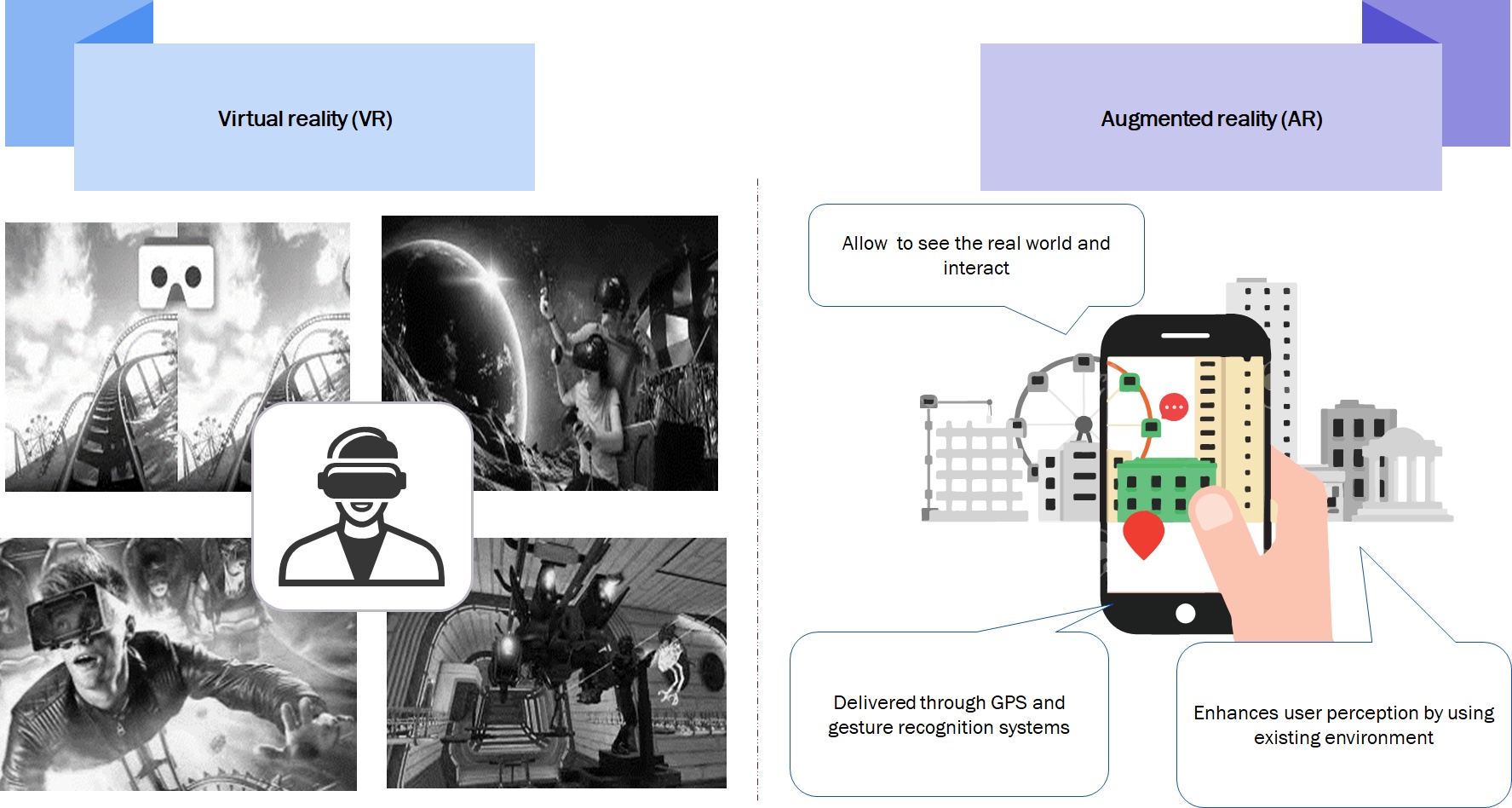

2.1 Augmented Reality (AR) / Virtual Reality (VR)

VR provides an engaging user experience by creating a virtual world or simulating the real world. It makes use of sensors built into a headset to provide interactivity with the virtual world. AR is based on the real world; however, it provides a more comprehensive perception of it by overlaying additional data. Uses of these technologies include at-home virtual tourism, immersive shopping, video streaming and interactive gaming. 5G will enable AR and VR by providing high bandwidth for data heavy uses (virtual tourism and video streaming) and low latency for interactive solutions (interactive shopping and gaming).

Analysys Mason in a recent engagement forecasted the market size for AR/VR video-on-demand and gaming in a GCC country to grow at a CAGR of 35-40% between 2020 and 2028 and account for 12-18% of the overall 5G IoT market in the country by 2028.

The research and development wing of the British Broadcasting Company (BBC R&D) conduct an elaborate AR and VR trial in which a historical reconstruction of a real location was aligned with, and superimposed upon, the same location in the real world. The trial used a 60GHz 5G mesh network and achieved a round-trip latency of 200ms.

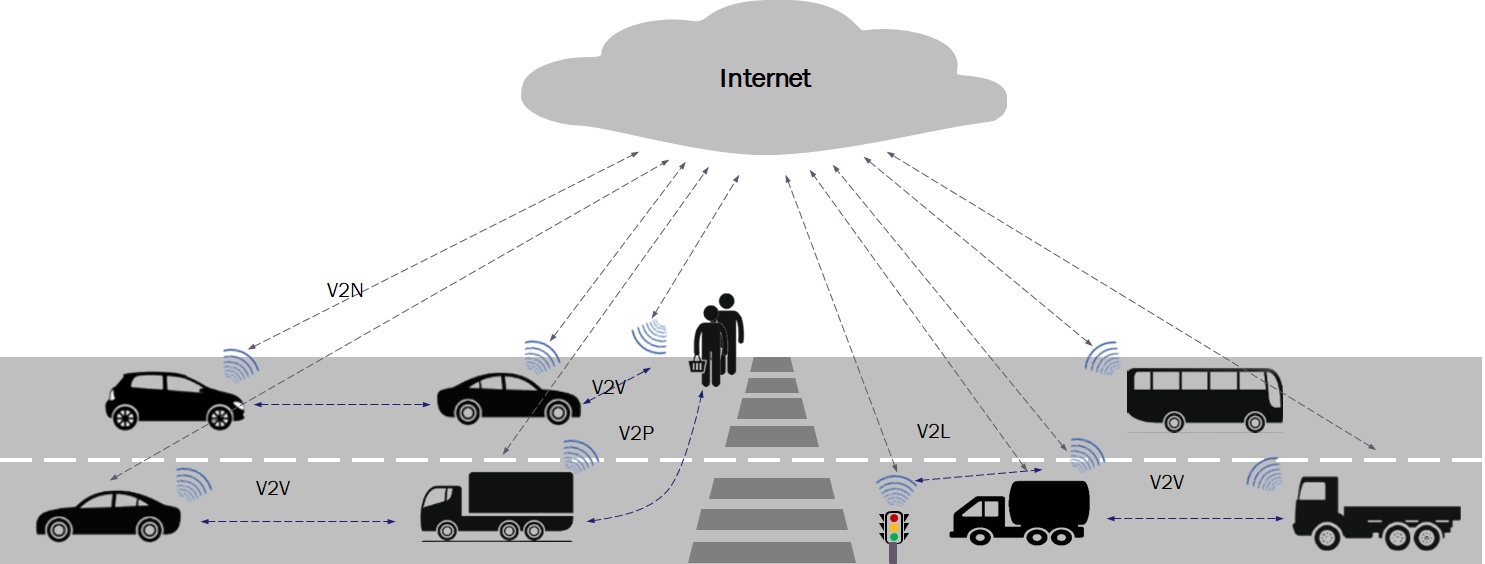

2.2 Smart driving

Smart driving involves vehicles that leverage sophisticated technology to guide themselves without human intervention. These automobiles will require sophisticated wireless telecoms capability in order to communicate with one another, with local traffic control systems, with manufacturers and with third-party service providers. 5G functionalities like network slicing and edge computing will be crucial to ensuring that all the data captured by sensors on vehicles and/or via 5G connections between vehicles and networks can be aggregated and managed reliably in real time.

Analysys Mason forecasted the market size for autonomous vehicles (only connectivity revenues) in a GCC country to grow more than 20-fold between 2023 and 2028 and account for 15-20% of the overall 5G IoT market in the country by 2028.

Telefónica conducted its first 5G demonstration in 2018 which included an autonomous vehicle as well as in-vehicle entertainment. The demonstration used an EasyMile EZ10 autonomous minibus on a 5G network using the 3.5GHz band. In-vehicle entertainment included virtual office, tourism points of interest and streaming entertainment. Several similar tests have been conducted in GCC, with UAE in particular being at the forefront of adoption. The Navya Autonom Shuttle in Masdar City, Abu Dhabi can transport 12 people at a top speed of 25km/hr. Similarly, demonstrations on the Jaguar iPace and a Mercedes have been conducted in Dubai and on the Dubai-Abu Dhabi route.

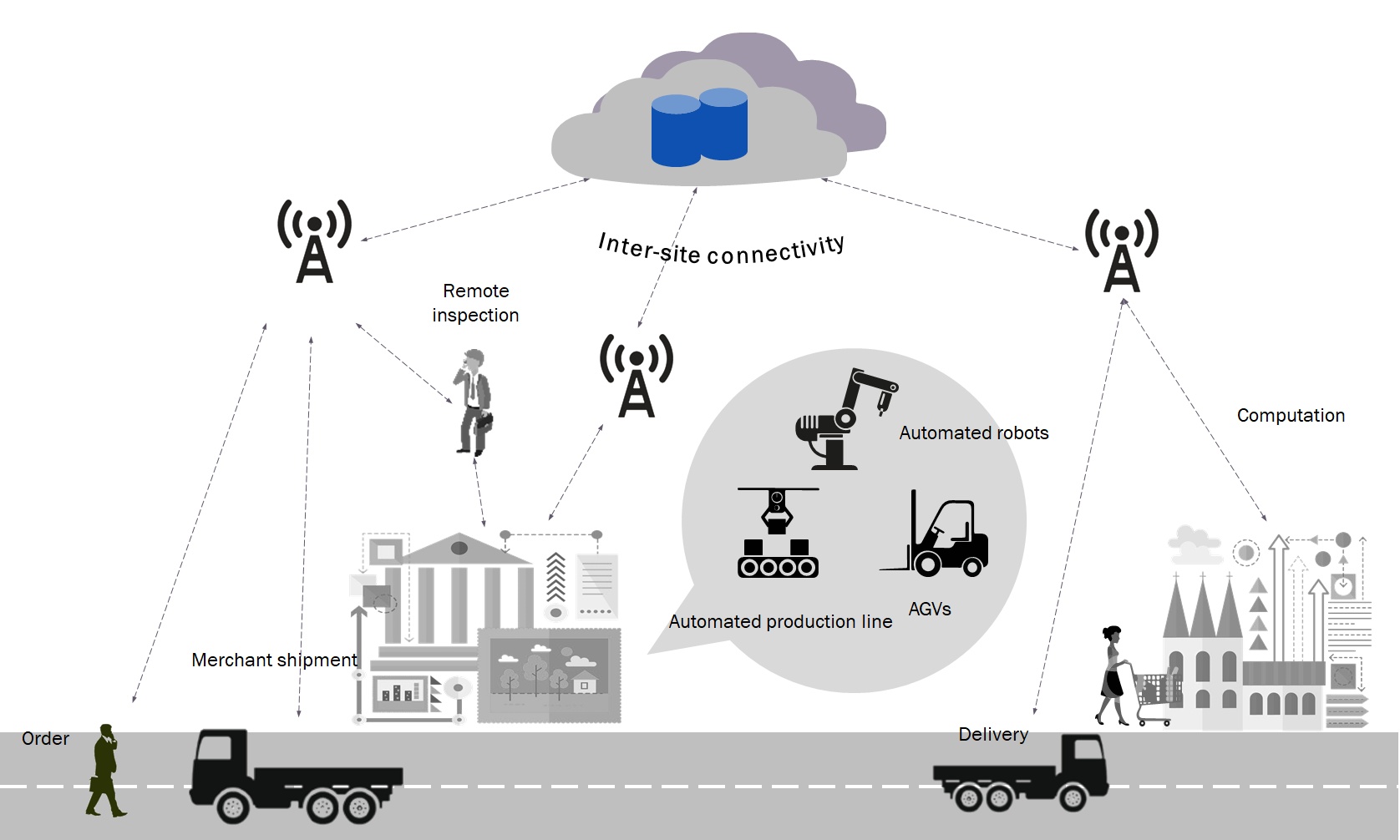

2.3 Smart manufacturing

Smart manufacturing integrates computing, networking and physical processes to improve the ways in which manufacturing businesses are run. The manufacturing industry increasingly requires flexible production methods to meet demand from a diverse and demanding customer base. 5G can transform the manufacturing processes by making them more modular and flexible through information dissemination among a wide variety of connected things (such as equipment, control systems and products). This can include process optimization, automated robots, remote operations through digital twins, etc.

The market size for connected manufacturing (production line automation and automated guided vehicles) in a GCC country is forecasted to grow at a CAGR of 40-45% between 2023 and 2028.

Ericsson’s 5G-enabled Nanjing smart factory in China is the first operational smart factory in the world. The factory uses over 1,000 cellular IoT connections and is expected to breakeven in less than two years largely driven by process optimization gains through production line automation and significant reduction in maintenance costs (50% reduction). Ericsson also has plans to set-up its first smart factory in USA in 2020.

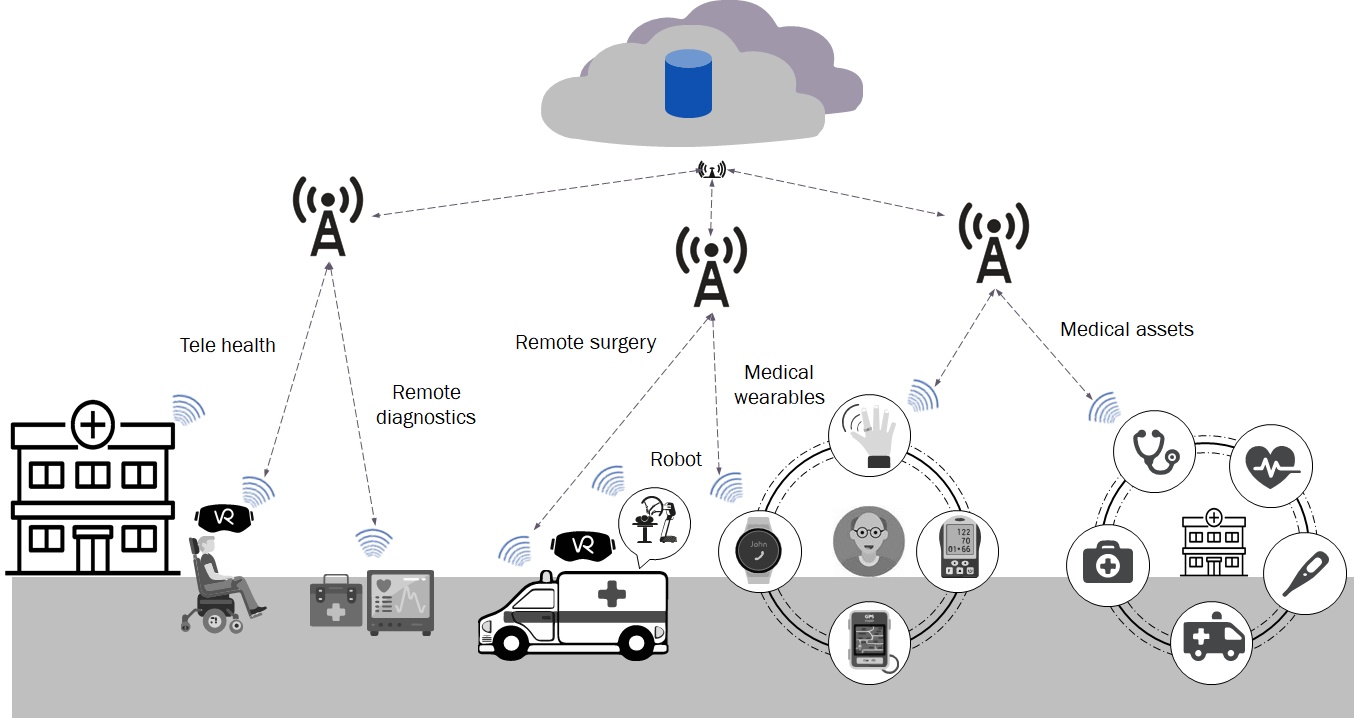

2.4 Smart health

Wider adoption of wearables, increased decentralization and ageing populations have led to a significant demand for increasing efficiencies in the healthcare industry along with new digital solutions. Smart health leverages technology that leads to enhanced diagnostic tools, more efficient treatment for patients, and devices that improve the quality of life for consumers. Applications include remote diagnosis and surgery, asset management, assisted living and wearables. 5G becomes extremely crucial for URLLC use cases within smart health such as remote surgery which can only work on extremely low latency.

The market size for remote patient monitoring in the MENA region is forecasted to grow at a CAGR of 10-15% between 2023 and 2028 and account for 12-14% of the overall IoT market in MENA by 2028. 5G is expected to capture 20% of the market.

China’s PLA General Hospital (PLAGH) collaborated with China Mobile and Huawei to perform the first-ever 5G remote brain surgery. The surgery was conducted in about three hours and the patient was located 3,000km away from the surgeon. Post the operation, the doctor mentioned, “The 5G network has solved problems like video lag and remote-control delay experienced under the 4G network, ensuring a nearly real-time operation”.

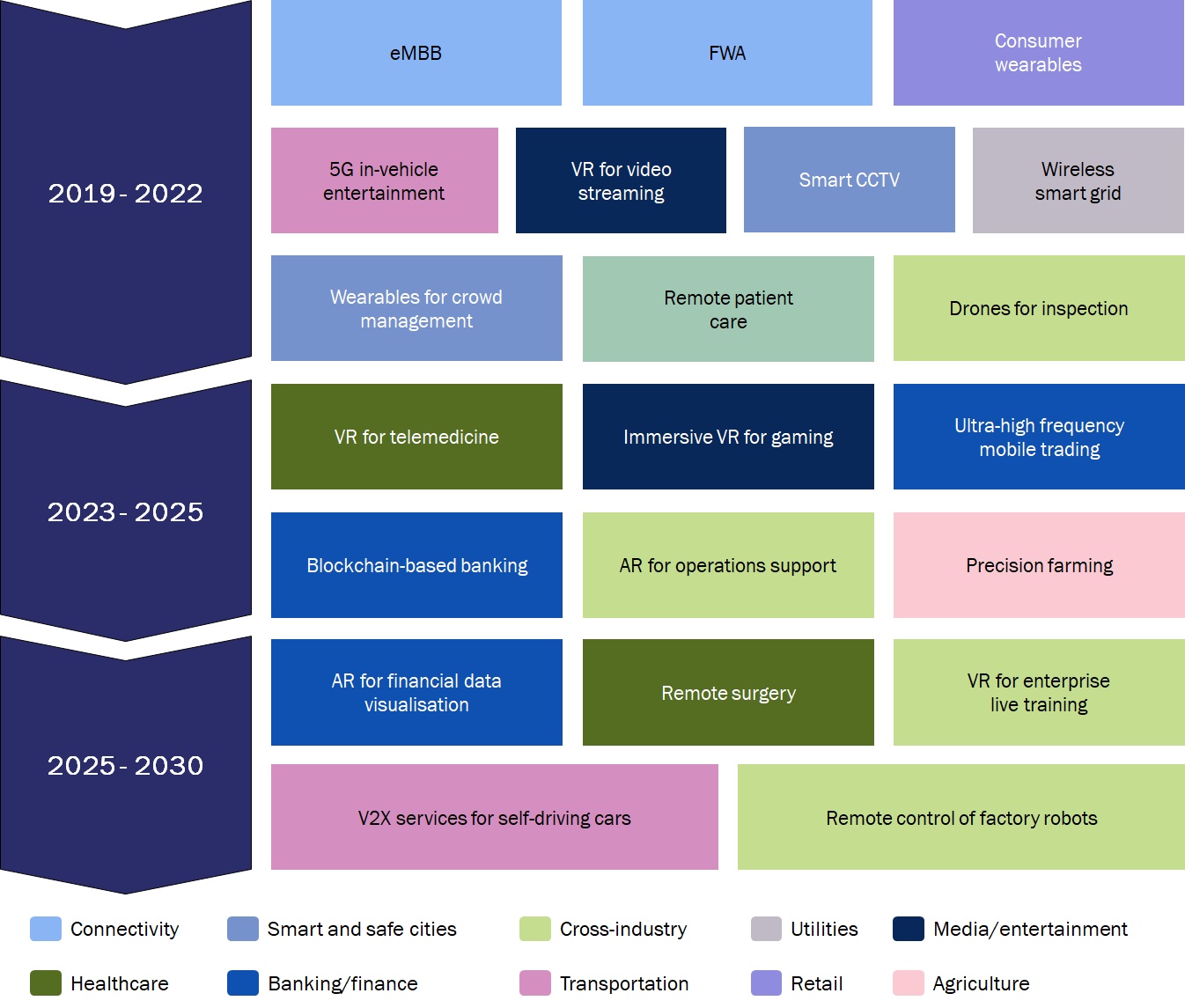

3. Adoption timeline for GCC

Operators may struggle to identify the 5G use cases that may be relevant to them in the short, medium and long term. When selecting use cases to focus on, operators need to consider a range of factors such as their existing relationships, current service offerings to industry segments, the investment requirements, and the revenue opportunities presented by each use case. Considering the dominant industry sectors in the GCC, timing of availability of technologies (e.g. URLLC use cases require 5G standalone core which is not expected to be deployed before 2022) and operator relationships with customer segments, the figure below provides a potential adoption timeline for 5G use cases in the GCC.

eMBB and FWA will be amongst the first use cases to be adopted (already offered in multiple countries), followed by use cases that are enhanced by 5G, but can also work on older technologies (smart grid, wearables, drones, etc.). Mission critical use cases will primarily be adopted once 5G standalone deployments begin and include URLLC use cases such as remote surgery, ultra-high frequency mobile trading and autonomous vehicles.