Industry Thought Leadership

5G Rollout in MENA Accelerates with Widespread Network Launches

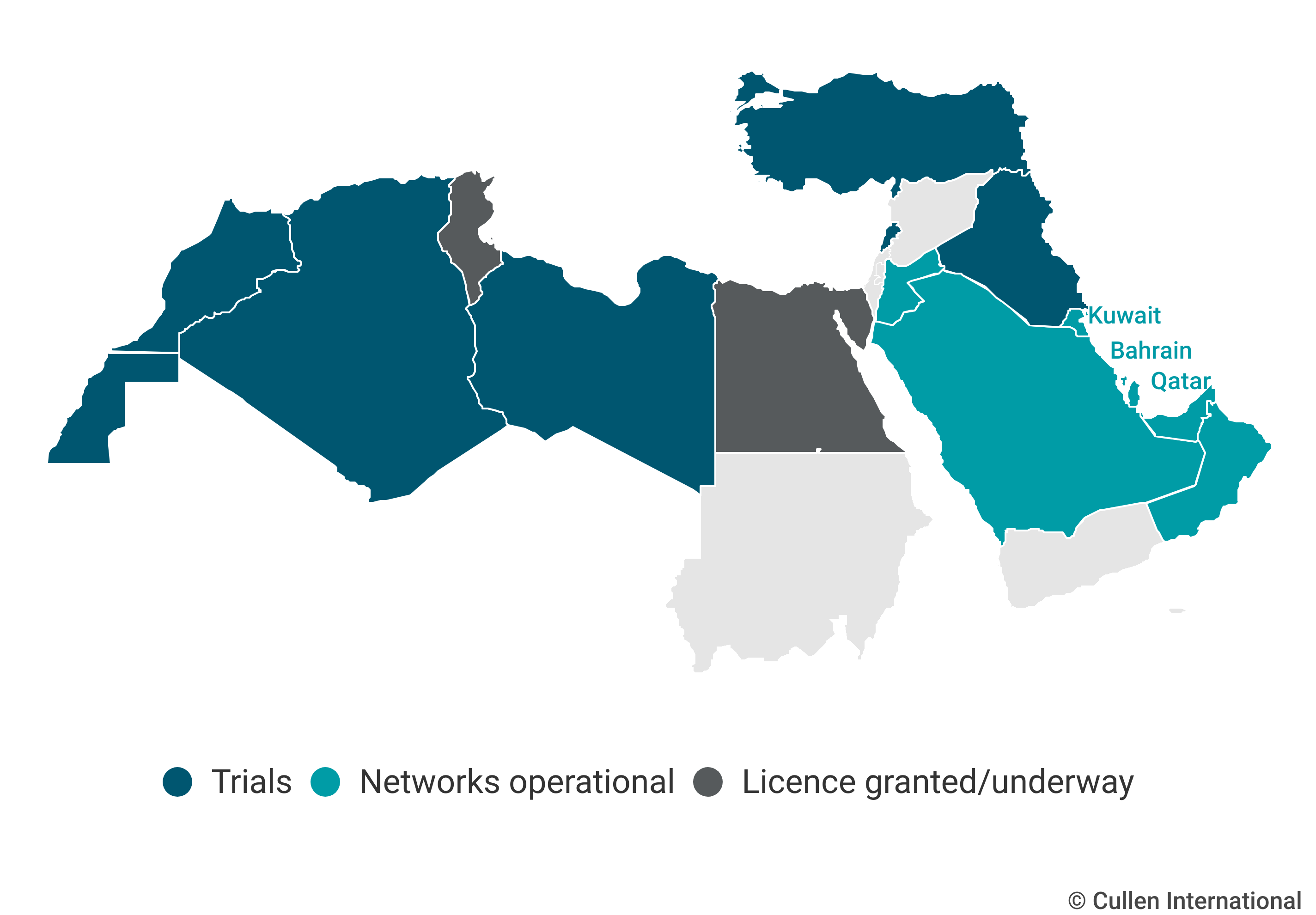

July, 20245G deployment in the MENA region is progressing quickly. Operators in some countries have already rolled out 5G networks with widely available coverage, while others are preparing for future launches. Regulators have adopted different strategies and approaches for 5G spectrum, coverage, and quality standards, highlighting each market’s unique challenges and opportunities.

Ten operators in the MENA region have achieved 5G network coverage that exceeds 90% of the population. This extensive coverage is a testament to the region's commitment to advancing digital infrastructure, despite the varying speeds of rollout across different countries.

19 operators across seven observed MENA countries have successfully launched commercial 5G services, marking significant progress in the region's telecommunications landscape. These seven countries are Bahrain, Jordan, Kuwait, Qatar, Oman, Saudi Arabia and the United Arab Emirates (UAE).

Other MENA countries have reached an advanced preparatory stage. For instance, Egypt granted Telecom Egypt a 5G licence, paving the way for its upcoming 5G service launch. Meanwhile, the Tunisian Ministry of Communication Technologies launched in June 2024 a call for tender to award the 5G licence, aiming for network rollout to start in 2025.

All observed countries in the MENA region are trialling, preparing or have launched 5G services

In Algeria, Iraq, Lebanon, Libya, Morocco, and Türkiye, operators have conducted several 5G trials, setting the foundation for future commercial 5G launches.

Spectrum allocation and usage

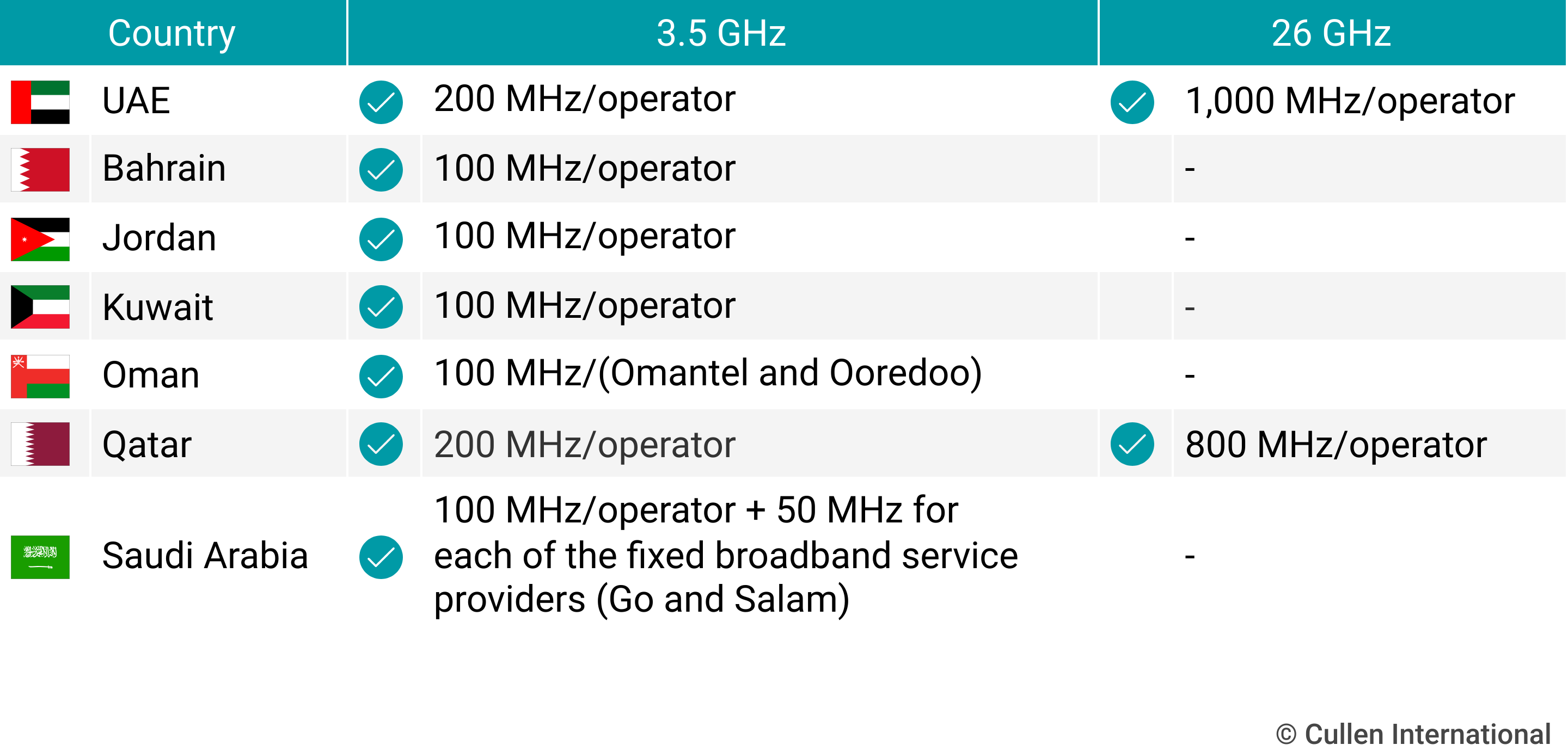

The 3.5 GHz band has been the most commonly used spectrum band for 5G services across the region, with operators in all seven operational countries utilising this band to deliver their high-capacity networks. Additionally, some operators are leveraging the 700 MHz and 2.6 GHz bands to enhance 5G coverage and capacity.

Qatar and the UAE have taken a pioneering step by awarding spectrum in the 26 GHz band to mobile operators, enabling them to explore the potential of millimetre-wave technology for ultra-high-speed services.

In addition to the existing allocations, several countries have plans to release more spectrum to support 5G. Saudi Arabia is set to allow operators to acquire additional spectrum in the 600 MHz, 1.5 GHz, and 3.8 GHz bands.

Similarly, Bahrain's Telecommunications Regulatory Authority has announced plans to auction additional spectrum in the 700 MHz, 1.5 GHz, 2.3 GHz, 2.6 GHz, and 3.8 GHz bands.

Coverage requirements and quality of service (QoS) standards

Jordan, Oman and Qatar have established 5G coverage requirements, although their approaches vary significantly.

In Jordan, the regulator TRC required mobile operators to cover 50% of the population within four years and 75% within nine years from the spectrum award date.

Qatar has set ambitious targets for nationwide coverage, while Omani operators were required to install 4,400 base stations by 2024.

Coverage obligations and QoS requirements in Saudi Arabia are not technology-based. Saudi Arabia has introduced a phased plan to achieve an average 5G download speed of 200 Mbps by 2025.

Ten operators in the MENA region have achieved 5G network coverage that exceeds 90% of the population. This extensive coverage is a testament to the region's commitment to advancing digital infrastructure, despite the varying speeds of rollout across different countries.

All observed countries in the MENA region are using 3.5 GHz