Page 13 - SAMENA Trends - February 2022

P. 13

REGIONAL & MEMBERS UPDATES SAMENA TRENDS

MEMBERS NEWS

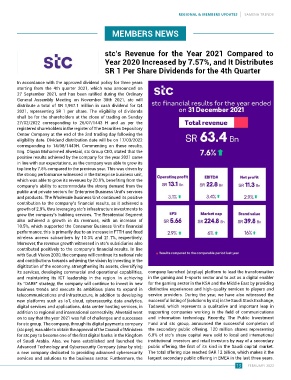

stc’s Revenue for the Year 2021 Compared to

Year 2020 Increased by 7.57%, and It Distributes

SR 1 Per Share Dividends for the 4th Quarter

In accordance with the approved dividend policy for three years

starting from the 4th quarter 2021, which was announced on

27 September 2021, and has been ratified during the Ordinary

General Assembly Meeting on November 30th 2021, stc will

distribute a total of SR 1,997.1 million in cash dividend for Q4

2021, representing SR 1 per share. The eligibility of dividends

shall be for the shareholders at the close of trading on Sunday

27/02/2022 corresponding to 26/07/1443 H and as per the

registered shareholders in the register of The Securities Depository

Center Company at the end of the 2nd trading day following the

eligibility date. Dividend distribution date will be on 17/03/2022

corresponding to 14/08/1443H. Commenting on these results,

Eng. Olayan Mohammed Alwetaid, stc Group CEO, stated that the

positive results achieved by the company for the year 2021 came

in line with our expectations, as the company was able to grow its

top line by 7.6% compared to the previous year. This was driven by

the strong performance witnessed in the Enterprise business unit,

which was able to grow its revenues by 20.9%, benefiting from the

company’s ability to accommodate the strong demand from the

public and private sectors for Enterprise Business Unit's services

and products. The Wholesale Business Unit continued its positive

contribution to the company’s financial results, as it achieved a

growth of 2.9%, thru leveraging stc’s infrastructure investments to

grow the company’s hubbing services. The Residential Segment

also achieved a growth in its revenues, with an increase of

10.5%, which supported the Consumer Business Unit’s financial

performance, this is primarily due to an increase in FTTH and fixed

wireless access subscribers by 10.3% and 21.7%, respectively.

Moreover, the revenue growth witnessed in stc’s subsidiaries also

contributed positively to the company’s financial results. In line

with Saudi Vision 2030, the company will continue its national role

and contributions towards achieving the vision by investing in the

digitization of the economy, strengthening its assets, diversifying

its services, developing commercial and operational capabilities, company launched (stcplay) platform to lead the transformation

and maintaining its ICT leadership in the region. In achieving in the gaming and E-sports sector and to act as a digital enabler

its “DARE” strategy, the company will continue to invest in new for the gaming sector in the KSA and the Middle East by providing

business trends and execute its ambitious plans to expand in distinctive experiences and high-quality services to players and

telecommunications and infrastructure, in addition to developing service providers. During the year, we have also witnessed the

new platforms such as IoT, cloud, cybersecurity, data analytics, successful listing of (solutions by stc) in the Saudi Stock Exchange,

digital services and applications, data center hosting services, in Tadawul, which represents a qualitative and important leap in

addition to regional and international connectivity. Alwetaid went supporting companies working in the field of communications

on to say that the year 2021 was full of challenges and successes and information technology. Recently, The Public Investment

for stc group. The company, through its digital payments company Fund and stc group, announced the successful completion of

(stc pay), was able to obtain the approval of the Council of Ministers the secondary public offering. 120 million shares representing

for stc pay to become one of the first digital banks in the Kingdom 6.0% of stc’s share capital were sold to local and international

of Saudi Arabia. Also, we have established and launched the institutional investors and retail investors by way of a secondary

Advanced Technology and Cybersecurity Company (sirar by stc); public offering, the first of its kind in the Saudi capital market.

a new company dedicated to providing advanced cybersecurity The total offering size reached SAR 12 billion, which makes it the

services and solutions to the business sector. Furthermore, the largest secondary public offering in EMEA in the last three years.

13 FEBRUARY 2022